Analytics & Risk Intelligence Leader based in Raleigh, NC.

Senior BI analyst at Navy Federal, building predictive credit-risk systems and operational data tooling.

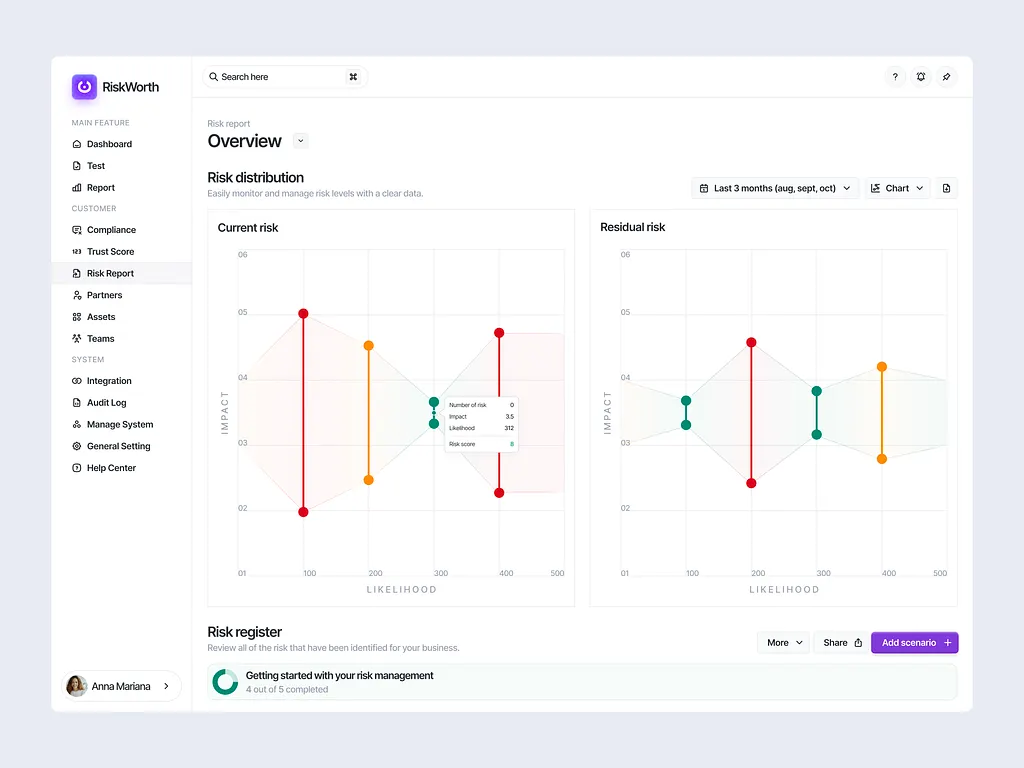

Credit-Risk

Interactive dashboard highlighting borrower credit risk and early warning signals.

Context

Real estate lending had grown across mortgage and HELOC, but risk reporting was fragmented by product and system. Leaders only saw issues after delinquency spiked.

Solution

Consolidated origination, performance, and collections data into a single credit-risk view, segmented by product, borrower profile, and geography.

Impact

Gives risk and executive teams an early-warning layer to identify pockets of emerging risk and align pricing, policy, and capacity decisions before losses accelerate.

SCRA Automation

Automated re-amortization process to manage SCRA loan adjustments at scale.

Context

SCRA rate adjustments were executed through manual spreadsheets and ad-hoc requests, creating operational risk and inconsistent member outcomes.

Solution

Designed an automated re-amortization process that flags eligible loans, recalculates schedules at the SCRA rate cap, and produces clean adjustment files for servicing.

Impact

Standardizes SCRA processing, reduces review effort for operations and compliance, and improves confidence that eligible members are treated consistently.

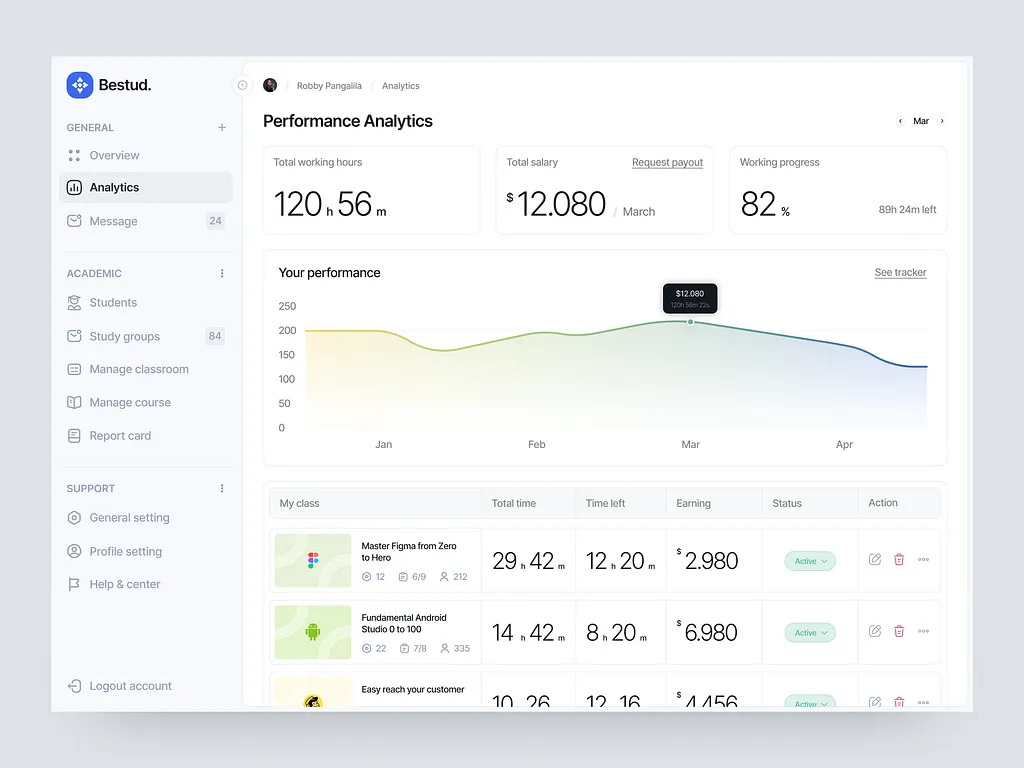

Underwriting

Dynamic scoring and throughput metrics to improve underwriting performance.

Context

Underwriting performance was discussed in anecdotes. There was no consistent view of cycle time, quality, or where deals stalled in the pipeline.

Solution

Built a metrics layer and dashboard for throughput, decision outcomes, and ageing across products, channels, and borrower segments.

Impact

Equips leaders with a fact-based view of where work slows down, so they can adjust staffing, policy, and handoffs with measurable impact on approval speed and quality.

Lender

Executive benchmarking to compare lending performance against peers.

Context

Executives needed a clear view of how the lending portfolio compares to peers on growth, profitability, and risk appetite.

Solution

Developed a benchmarking view that integrates internal portfolio metrics with peer and market data to position performance against a defined peer set.

Impact

Supports board and strategy discussions with objective context on where the institution is leading, lagging, or intentionally differentiated from peers.